Free Ideas For Deciding On RSI Divergence Trading

Wiki Article

Okay, let's begin by asking the obvious query and explore what is RSI Divergence is and what trading signals we can derive from it.|Let's begin with the obvious question. Let's look into what RSI Divergence means and what trading clues it can provide.|Let's start with the obvious question. We'll look into the definition of RSI Divergence actually is and the trading information we can get from it.|Okay, let's begin by asking the obvious question. We'll look into what RSI Divergence really is and what trading signals we could take away from it.|Let's begin with the obvious question. Now, let us explore what RSI Divergence looks like and the trading signals that can be gleaned from it.} Divergence happens when the price action is not aligned with the RSI indicator. In an economy that is in a downtrend, the price action makes lower lows and the RSI indicator has lower lows. A divergence happens the time when an indicator does not agree with the price action. This situation should be an indicator that you must pay close attention to the market. Based on the chart it appears that both bearish RSI divigence (bullish) and bearish RSI divigence (bearish) are obvious. However, the price action actually reversed in response to both RSI Divergence signals. Let's continue to the topic that is exciting. Have a look at the best cryptocurrency trading bot for blog tips including trading divergences, forex backtesting software, crypto trading, backtester, crypto trading backtesting, automated trading bot, trading platform, forex backtester, forex backtest software, backtesting strategies and more.

How Can You Analyse Rsi Divergence

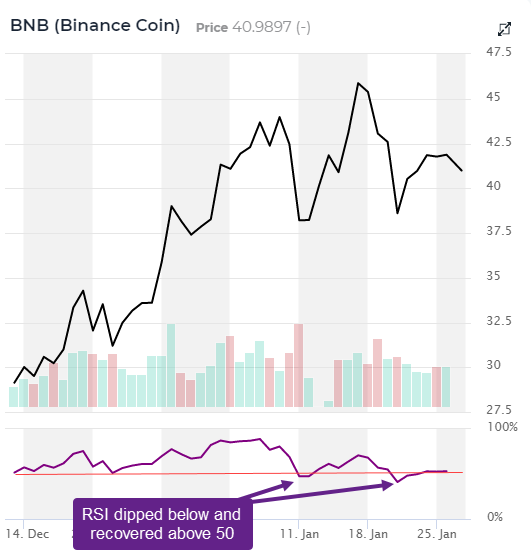

Since we are using the RSI indicator to identify trend reversals, it is vital to find the right trend reversal, for that, we need to have an uptrending market. Then we can use RSI divergence to determine the weaknesses of the current trend and then use that information to catch the trend reversal at the right time.

How Can You Tell If There Is Rsi Divergence During Forex Trading

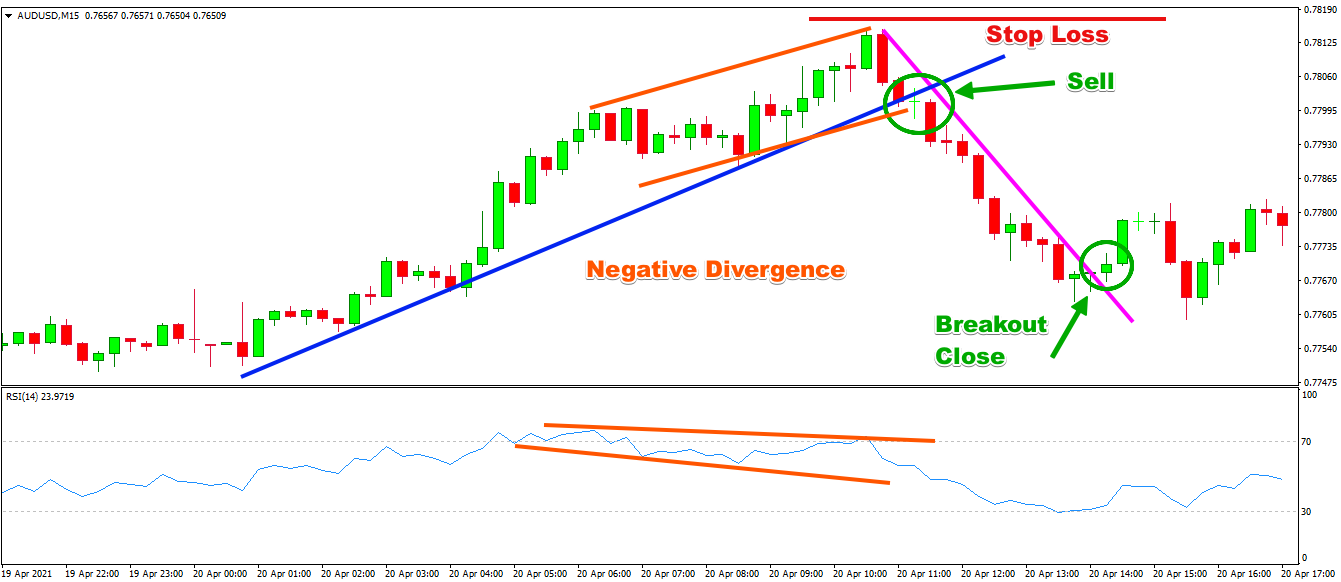

Both Price Action (RSI indicator) and Price Action (Price Action) did exactly the same thing at the start of the trend, making higher highs. This usually indicates that the trend is solid. The trend is concluded with Price making higher highs, but the RSI indicator has lower highs. This suggests that something needs to look out for within this chart. Here is the reason to pay focus on the market. Both the indicator and the price action are not in sync that indicates an RSI divergence. In this instance, the RSI divergence indicates bearish trend rotation. Have a look at the chart above and notice what transpired following the RSI divergence. You can see that the RSI divergence is highly precise in identifying trend reversals. The question is: How do you spot the signs of a trend reversal? Let's take a look at four strategies for trading that mix RSI divergence with higher probability signals. Take a look at top backtesting tool for site examples including RSI divergence cheat sheet, backtesting strategies, backtesting tool, forex backtesting, automated forex trading, forex backtester, stop loss, backtesting tool, backtesting strategies, best trading platform and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Two variants of the triangle chart pattern are offered. The pattern of the ascending triangle can be used to reverse a downtrend. The second is the descending triangular pattern, which is employed in uptrend markets as an opportunity to reverse. Let's take a closer look at the chart of forex and see the downwards-facing circle pattern. Similar to the previous instance, the market was in an upward trend and then the price began to fall. RSI is also a sign of divergence. These signals reveal the flaws in this trend. We now know that the uptrend that is currently in place has lost momentum. As a result of that the price formed the descending triangle. This confirms that there has been an inverse. It is now time to begin short-term trading. Like the trade we did before, we used the same breakout strategies to execute this trade. Let's now get to the third entry technique. This time we are going to pair trend structure with RSI divergence. Let's look at how to trade RSI divergence when the trend is shifting. Read the top automated trading for website info including divergence trading, trading with divergence, crypto trading backtester, backtesting platform, trading platform crypto, trading platform, automated trading software, automated forex trading, backtesting platform, forex tester and more.

Tip #2 – Combining the RSI Divergence Pattern with the Head & Shoulders Pattern

RSI divergence is a tool forex traders employ to identify market reversals. Combining RSI diversence with other reversal indicators like the Head and shoulders patterns could increase our chances of winning. This is great! Let's examine how we can make trades more profitable by combining RSI diversification along with the Head and Shoulders pattern. Related: Trading Head and Shoulders Patterns in Forex: A Reversal Trading Strategy. It is important to make sure that the market is favorable prior to making a decision on the entry of trades. Because we're looking for a trend reversal, It is best to have a trending market. The chart is below. Read the most popular automated cryptocurrency trading for more examples including RSI divergence, forex backtesting, trading platform, bot for crypto trading, backtesting strategies, automated trading software, automated trading bot, divergence trading, forex backtesting software, best trading platform and more.

Tip #3 – Combining RSI Divergence With the Trend Structure

The trend is our friend. The trend is our friend as long as it's trending, we need to trade in the direction of its movement. This is what professionals instruct us. This trend isn't going to last for a long time. It will turn around at some moment. Let's look at how we can recognize those reversals by observing the structure of the trend and RSI divergence. We know that the uptrend is forming higher high while the downtrend is making lower lows. With that in mind, let's take a closer look at the chart below. The chart's left side displays an uptrend, and the series showing highs and lows. You can also see the RSI deviation (Red Line). Price action is the cause of Lows, however the RSI create higher lows, do you think? What does this indicate? Despite market creating lows however, the RSI is doing the exact opposite. This means that a trend that is continuing is losing its momentum. It's time to get ready for a reversal. Follow the best crypto trading for more tips including crypto trading bot, automated cryptocurrency trading, crypto backtesting, forex backtesting software, backtesting platform, forex backtesting, crypto trading bot, backtesting platform, best forex trading platform, cryptocurrency trading and more.

Tip #4 – Combining Rsi Divergence And The Double Top/Double Bottom

A double top, or double bottom, is a reversal trend that forms after an extended move. Double tops form when the price reaches an unbreakable threshold. Once that level is reached, the price will retrace little before returning to the level it was at. If the price bounces off this level, there is an OVER-OP. Below is the double top. The double top that you see above shows two tops that resulted from a powerful move. The second top is not able surpass the one. This is an obvious sign that a reverse is on the way since it indicates that buyers are having difficulty going higher. The same principles apply to the double bottom, however it's in reverse. Here we will use the method of entry using breakouts. We execute a sell trade when the price falls below the trigger level. Within a day, our take-profit achieved. QUICK PROFIT. It is also possible to use the same strategies for trading the double bottom. The following chart shows the best way you can trade RSI Divergence with Double Bottom.

This isn't the most effective trading strategy. There is no single strategy for trading that is flawless. In addition each trading strategy has losses. While we earn consistent profits with this trading strategy however, we also implement strict risk management and a quick way to cut down our losses. This helps us reduce drawdown, which opens up the possibility of massive upside potential.